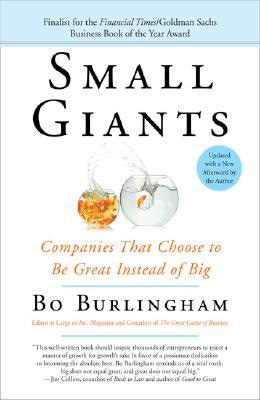

This document summarizes the core principles and critical observations presented in the provided excerpts from "Small Giants" by Bo Burlingham. The text highlights a distinct approach to business success that prioritizes qualities beyond relentless growth, focusing instead on culture, community, craftsmanship, and the personal values of the founders.

I. The "Free to Choose" Philosophy: Growth vs. Purpose

A central theme is the concept of "free to choose," challenging the conventional wisdom that businesses must relentlessly pursue maximum growth and size. The text introduces the idea that true success can lie in consciously limiting growth to preserve other cherished aspects of the company.

Challenging the Growth Imperative: Many successful entrepreneurs reach a "crossroads" where they can choose to prioritize scale or maintain their unique character. Fritz Maytag of Anchor Brewing, for example, realized his company "didn’t have to keep growing ever bigger and more impersonal. He had a choice." He consciously decided "not to grow" and instead aimed for "a small, prestigious, profitable business."

The Revelation of Choice: For many "small giants," this choice comes as a "moment of revelation—often right as they’re about to make an irrevocable decision." Gary Erickson of Clif Bar, for instance, pulled back from a $120 million acquisition offer at the last minute, realizing the sale would compromise the company's values.

Fighting for the Choice: The text emphasizes that maintaining this choice requires deliberate effort: "If you want to have the choice, you have to fight for it. All successful businesses face enormous pressures to grow, and they come from everywhere—customers, employees, investors, suppliers, competitors—you name it."

The "Recovering Entrepreneuraholic": Jay Goltz of Artists Frame Service, who described himself as "a recovering entrepreneuraholic," illustrates the psychological pull of constant growth. He realized: "For years, I’d been pushing, pushing, pushing, and suddenly I realized I could stop. I began to think, What would you do with all that money if you made it anyway? That was a revelation." His struggle highlights a common "disability, namely, his own blindness to what he had accomplished."

The Risk of External Investment: Taking outside investment often leads to a loss of independence and a mandate for aggressive growth. Martin Babinec of TriNet, Inc., for example, found that the initial $50,000 investment came "with obvious strings attached. The investors had rescued Babinec, and he was now obligated to give them what he’d promised and what they expected, namely, a good return on their investment. That meant growing the company fairly aggressively." Eventually, he sold a "controlling interest" to a large European staffing company.

II. Defining "Mojo" and its Generators

The book seeks to understand "mojo"—the "mysterious quality these companies shared"—which employees define as "‘You got that engine running baby and the sky is the limit!’" This "corporate charisma" is linked to a combination of factors, deeply rooted in the company's internal and external relationships.

Intimacy as a Core Generator: A key aspect of mojo is the deep "intimacy they are able to achieve with employees, customers, suppliers, and the community—an intimacy that is both one of the great rewards and one of the crucial generators of the mojo they exude."

Active Appreciation of Positive Impact: Leaders of "small giants" have "an active appreciation of a business’s potential to make a positive difference in the lives of the people it comes into contact with." This informs their relationships and decision-making.

III. The Importance of Community and "Terroir"

Small giants are not just located in a community; they are deeply part of it, often shaping and being shaped by their local environment, a concept likened to "terroir" in winemaking.

Deep Community Roots: "The companies in this book were all deeply rooted in their communities, and it showed. Each had a distinctive personality that reflected the local environment."

Community as a Strategic Factor: Danny Meyer of Union Square Hospitality Group views "the community as a critical factor in deciding where he would open a restaurant, and what type of restaurant it would be." He famously applies a "five-minute rule," only opening restaurants he could walk to in five minutes from his home, emphasizing the need for physical presence and integration.

Symbiotic Relationship: The community connection is not just about giving back but is integral to the business's identity and success. For Zingerman's Deli, their deep connection with their Ann Arbor community means they can have unique relationships, such as naming a sandwich after a long-time customer: "That’s a good example of terroir because people like that are present in a significant way in this community, and we can have that kind of connection with him—because we’re here. We wouldn’t have it if we weren’t here, and we wouldn’t be here if we’d done the usual thing as far as growing goes.”

Quiet Social Responsibility: While active in their communities, these companies often differ from the "1990s brand of socially responsible business" by being "relatively quiet about what they did." Fritz Maytag of Anchor Brewing, for example, believes in "the business of a business is business" but quietly supports local groups and libraries, viewing the brewery as a "civic center" in the old European tradition.

Local Ethos as Strength: Righteous Babe Records, located in Buffalo, leveraged the city's "scrappy outsider and underdog" ethos to its advantage, benefiting from lower overhead and a strong sense of identity despite its seemingly disadvantageous location.

IV. Employee and Supplier Relationships: Loyalty and Trust

The internal culture and external partnerships of small giants are characterized by strong loyalty, trust, and a personal touch.

Valuing Employees Beyond Compensation: Fritz Maytag's approach to bonuses at Anchor Brewing demonstrates this: he found that regular bonuses became expected and lost their impact. Instead, he preferred to "pay people well and on a rational basis. And then do things like the barley harvest and the trips to Europe and the courses and the dinners and the ball games and the company van that you can borrow over the weekend if you’re moving." Norm Brodsky's "knock-your-socks-off policy" exemplified this by giving an early, unexpected raise and tuition assistance to an employee, ensuring she "knew the company cared about her."

Family vs. Non-Family Hiring: The text presents contrasting views on hiring family. W. L. Butler Construction "encourage[s] nepotism," seeing themselves as "a family business in the full meaning of the term." In contrast, Norm Brodsky of CitiStorage has a strict rule against hiring relatives or friends of current employees due to "three or four really bad incidents that convinced me we had to have it."

Supplier Loyalty: Just as they foster internal loyalty, small giants build strong relationships with suppliers. Righteous Babe Records' Scot Fisher was willing to walk away from a deal with a major national distributor (Koch Entertainment) because they "didn't want to abandon the two distributors of women’s music—Goldenrod and Ladyslipper—that had signed up early and promoted DiFranco when she was largely unknown." Koch eventually "came around."

V. Passion, Craftsmanship, and Problem Solving

Founders and leaders of small giants exhibit a deep passion for their craft and a unique approach to business challenges, often seeing them as puzzles to be solved creatively.

Passion as the Creative Impulse: The book states that "If there’s one thing that every founder and leader in this book has in common with the others, it is a passion for what their companies do. They love it, and they have a burning desire to share it with other people." Fritz Maytag speaks of Anchor Brewing's "theme" of purity and traditional methods, while Selima Stavola expresses joy in her work, waking up excited "about going to work." Even in a "mundane" business like records storage, Norm Brodsky describes his passion, seeing a "fabulous business" rather than just boxes.

Business as a Puzzle/Creative Challenge: For entrepreneurs like Norm Brodsky, "business is sort of a puzzle. We believe there’s a solution to every problem, and we think we can figure it out if we can just visualize what needs to be done. That usually means coming up with a different way of looking at the situation. You need a kind of peripheral vision." His realization that records storage was a "real estate business" allowed him to innovate and achieve better gross margins.

Continuous Improvement and Systems: Jay Goltz's obsession with "figuring things out" and developing systems (e.g., for managing production at Artists Frame Service) highlights a drive for efficiency and improvement that contributes to excellence.

VI. Financial Discipline and Sustainability

While not driven by maximizing short-term shareholder value, small giants demonstrate sound financial management, recognizing its importance for long-term independence and stability.

Three Financial Imperatives: The text outlines "three financial imperative for small giants": protecting gross margins, maintaining a healthy balance sheet, and having a sound business model.

Foreseeing Financial Crises: Norm Brodsky's past bankruptcy taught him the importance of the balance sheet, a lesson he applied when advising Nick Sarillo of Nick's Pizza & Pub, who was struggling with debt and lacked a consolidated P&L and balance sheet.

Capital-Intensive Business Challenges: Fritz Maytag's "epiphany" about financing growth in a capital-intensive business illustrates why many companies feel pressure to seek outside investment. Without sufficient after-tax profit, growth necessitates external capital, which can compromise independence.

Prioritizing Health over Short-Term Gains: Kyle Smith of Reell Precision Manufacturing faced pressure to increase revenue but prioritized long-term health, telling his board: "'Our revenues are going to retract for at least two years. But we are going to get healthy again. I’m going to get the balance sheet straightened out and put some cash in the bank, and then we’ll use that to fund growth. But we’re talking about a long-term thing here. If you want a one-year wonder, you probably ought to get someone else.'"

VII. Succession and the Legacy of the Founder

The long-term viability of small giants often poses a challenge, particularly concerning the founder's succession and the perpetuation of the company's unique culture and "mojo."

Founder-Dependent Mojo: For some companies like Selima Inc. and Righteous Babe Records, the company's identity is so intertwined with the founder's artistic vision that its continuation without them is difficult to imagine. "It was almost impossible to imagine either company without its founder."

Preserving Character: Fritz Maytag, facing retirement, expressed a desire for Anchor Brewing's unique "character" and "personality" to continue, even if not as a family business, highlighting the concern for legacy beyond financial gain.

The Challenge of Public Ownership and Sale: University National Bank & Trust Co. (UNBT) initially defied the norm as a publicly owned "small giant" with a philosophy of "measured and limited growth," maintaining high returns and loyal shareholders. However, regulatory pressures and the founder's health led to its sale to Comerica, and it "was never the same," losing its unique character.

Successful Transitions: Norm Brodsky sold a majority stake in CitiStorage, and Fritz Maytag sold Anchor Brewing to "liquor industry veterans committed to preserving the company’s spirit and culture," indicating that some successful transitions can occur while attempting to uphold core values. Danny Meyer spun off Shake Shack as a separate public company precisely "because he wanted USHG to remain a small giant."

In conclusion, "Small Giants" presents a compelling argument that business excellence and enduring success are not solely defined by exponential growth or market dominance. Instead, it champions a model where deep-seated passion, intimate relationships with employees, customers, suppliers, and community, strong financial discipline, and a deliberate choice to prioritize purpose over mere size lead to companies with a distinctive "mojo" and profound impact. The journey of these businesses often involves challenging conventional wisdom, fighting external pressures, and navigating the complexities of succession while striving to maintain their unique spirit and values.

Small Giants: A Study Guide

I. Quiz

Answer the following questions in 2-3 sentences each.

What was Fritz Maytag's "moment of revelation" regarding Anchor Brewing, and what decision did he make as a result?

How did Gary Erickson's decision to not sell Clif Bar for $120 million impact his relationship with his partner, Lisa Thomas, and what financial challenges did he face?

Explain the "five-minute rule" implemented by Danny Meyer for opening new restaurants and its practical reasons.

What unexpected business did Norm Brodsky realize he was in with CitiStorage, and how did this realization influence his business strategy?

Describe the unique qualities of University National Bank & Trust Co. (UNBT) and its founder, Carl Schmitt, that distinguished it from other banks.

How did Jay Goltz's self-described "entrepreneuraholic" addiction manifest, and what significant change did he undergo?

What is "mojo" in the context of "small giants," and how is it defined by the companies that possess it?

Discuss the relationship between small giants and their communities, providing an example from the text.

What was the central dilemma faced by Joe Arnold at Reell Precision Manufacturing regarding the cigarette display box project?

How did Fritz Maytag's approach to employee bonuses evolve, and what was his reasoning behind the change?

II. Answer Key

Fritz Maytag's moment of revelation came as he was preparing to take Anchor Brewing public, realizing he didn't have to pursue endless growth. He decided to remain a small, prestigious, and profitable business, valuing the current state of the company and the parts he loved most. This choice freed him to build a company he enjoyed and was proud of.

Gary Erickson's decision to reject the $120 million offer for Clif Bar led to a split with his partner, Lisa Thomas, who demanded $50 million for her share. He faced significant financial hurdles, including difficulty securing loans from commercial banks and mezzanine financing, ultimately borrowing $15 million at a 23% interest rate to buy her out. Despite the challenges, the company's subsequent success allowed him to refinance and gain full ownership.

Danny Meyer's "five-minute rule" meant he wouldn't open a restaurant more than five minutes' walk from his home. This rule was driven by his desire to be close to his family and to maintain a physical presence in each restaurant, observing and interacting with staff and customers during service. It allowed him to work lunch at all his restaurants in the same day, ensuring personal oversight.

Norm Brodsky realized that CitiStorage, his records storage business, was fundamentally in the real estate business, renting space to boxes. This insight led him to strategize on maximizing rent from his warehouses, such as designing high-ceilinged facilities to accommodate more boxes per square foot, and offering concessions like paying removal fees for new customers to ease their transition.

UNBT distinguished itself through its "un-cola banking" philosophy, featuring an alien crashing through a wall as its trademark and using humorous imagery on its trucks. Founder Carl Schmitt focused on a specific market, aimed for a limited 15% market share, and cultivated a zany corporate culture that attracted top talent and provided extraordinary customer service, including free shoe shines and Walla Walla sweet onion giveaways.

Jay Goltz's "entrepreneuraholic" addiction manifested as an incessant drive for growth, often fueled by a sense of inadequacy and comparing himself to the world's most famous entrepreneurs. He underwent a significant change when he realized he could stop pushing for constant expansion, appreciating his existing accomplishments and the positive impact he had on his community and employees.

"Mojo" in the context of "small giants" refers to a mysterious, charismatic quality that these companies share, often defined by its positive effects. One employee described it as, "You got that engine running baby and the sky is the limit!" It stems from an active appreciation of a business's potential to make a positive difference and fosters intimacy with stakeholders.

Small giants are deeply rooted in their communities, and this connection often shapes their distinctive personality and success. For instance, Righteous Babe Records, located in Buffalo, drew strength from the city's "underdog" ethos, which imbued the company with a scrappy spirit and offered practical benefits like lower overhead and competitive prices, allowing it to thrive against the odds.

Joe Arnold, an engineer at Reell Precision Manufacturing, faced a moral dilemma when assigned to develop a hinge for a cigarette display box. He struggled with promoting a product that could harm people, despite finding the engineering challenge exciting. This personal conflict, shared by his office mate and wife, led him to question his involvement in the project.

Fritz Maytag initially paid regular bonuses at Anchor Brewing but found they lost their impact, becoming expected compensation rather than a reward. He decided to stop paying them regularly, explaining his reasoning to employees. Then, he would pay a bonus unexpectedly, and wait a long time before the next, aiming to truly convey appreciation and make the rewards feel special.

III. Essay Questions

Analyze how the concept of "choice" is central to the identity and success of the "small giants" described in the text. Discuss how different founders, such as Fritz Maytag, Gary Erickson, and Danny Meyer, exercised this choice in critical moments and the implications for their businesses.

The text suggests that a company's "mojo" is intrinsically linked to its "active appreciation of a business’s potential to make a positive difference in the lives of the people it comes into contact with." Discuss how this appreciation manifests in the relationships small giants foster with their employees, customers, suppliers, and communities. Provide specific examples from at least three different companies.

Compare and contrast the financial management strategies of two or more "small giants" when faced with pressures for growth or financial crises. How did their approaches to debt, gross margins, and business models reflect their values and ultimately affect their long-term sustainability?

Explore the role of the founder's personality and vision in shaping the culture and trajectory of a "small giant." Using examples like Carl Schmitt of UNBT, Obert Tanner of O.C. Tanner Company, and Ani DiFranco of Righteous Babe, discuss how their unique qualities and passions influenced their companies' operational practices, employee relations, and overall identity.

The text discusses the challenges of succession planning and maintaining a company's unique character after a founder departs or sells. Analyze the different outcomes of succession for companies like Anchor Brewing, University National Bank & Trust Co., and Clif Bar. What factors contributed to these outcomes, and what does this suggest about the transferability of "mojo"?

IV. Glossary of Key Terms

Small Giant: A company that chooses to be great by focusing on things other than just growth, such as being the best at what they do, being great places to work, providing extraordinary customer service, making a positive impact on their communities, and being an enjoyable business for their owners.

Mojo: A mysterious, charismatic quality shared by successful "small giants," often defined by its positive effects and a sense of an "engine running" with unlimited potential. It is generated by a combination of factors including intimacy with stakeholders and a passion for excellence.

Culture of Ownership: A business environment where employees feel a personal stake in the company's success, often fostered through transparency, shared goals, and recognition of contributions.

Capacity Crisis: A situation where a company's demand outstrips its production or service capabilities, often forcing a decision about expansion or rationing.

Initial Public Offering (IPO): The first sale of stock by a private company to the public, allowing it to raise capital from public investors.

Mezzanine Financing: A hybrid of debt and equity financing that gives the lender the right to convert the debt to an equity interest in the company if the loan is not repaid in time or in full. It typically carries a higher interest rate than traditional bank loans.

Gross Margins: The difference between revenue and the cost of goods sold, indicating the profitability of a company's products or services before operating expenses. Protecting healthy gross margins is a financial imperative for "small giants."

Balance Sheet: A financial statement that reports a company's assets, liabilities, and owner's equity at a specific point in time, providing a snapshot of its financial health.

Business Model: The framework for how a company creates, delivers, and captures value. A "sound business model" is essential for long-term sustainability, adapting to changing circumstances, industries, and technologies.

Terroir: A concept borrowed from winemaking, referring to the unique environmental factors (like geography, climate, and local culture) that influence the character of a product. In business, it refers to the deep connection a company has with its community and how that community shapes its identity and success.

Entrepreneuraholic: A self-described term for an entrepreneur driven by an insatiable desire for constant growth and expansion, often at the expense of other aspects of life or business quality.

Peripheral Vision (in business): The ability to look at a business or industry from different angles and identify opportunities or solutions that others might miss, often by challenging conventional wisdom.

Succession Planning: The process of identifying and developing new leaders who can replace old ones when they leave, retire, or die, ensuring the continuity and future success of the organization, especially in preserving the unique character of a "small giant."

Employee Stock Ownership Plan (ESOP): A retirement plan that provides employees with an ownership interest in the company. It can be a mechanism for succession planning, allowing employees to buy out an owner.

One-Hundred-Year Trust: A long-term trust arrangement designed to ensure the continued independence and original vision of a company, often used in succession planning to prevent immediate sale or drastic changes.

Share this post